Faced With The Threat Of The Coronavirus, Investors Have Engaged In A ‘Flight To Safety

Posted by siteadmin on Monday 2nd of March 2020.

ollowing its emergence in central China in mid-January, the coronavirus has now been reported in 56 different countries. Of the more than 83,000 confirmed cases, nearly 3,000 have proved fatal. Though the rate of new infections in China has stabilised, and though the proportion of patients recovering has improved, the international spread of the virus has caused a great deal of alarm. As workers, shoppers and tourists stay home – either by choice or by government edict – expectations for economic growth and corporate profits have been revised downwards.

This has prompted sharp movements in global financial markets. As measured by the MSCI All Countries World index, global equities had, by yesterday’s close (27th February) fallen close to 10% from their peak in sterling terms. Thus far, stock markets have continued their downward march today, with Asian markets down c.3% and, at the time of writing, European markets following suit. By some measures, this has been the worst week for global equities since the depths of the financial crisis in 2008.

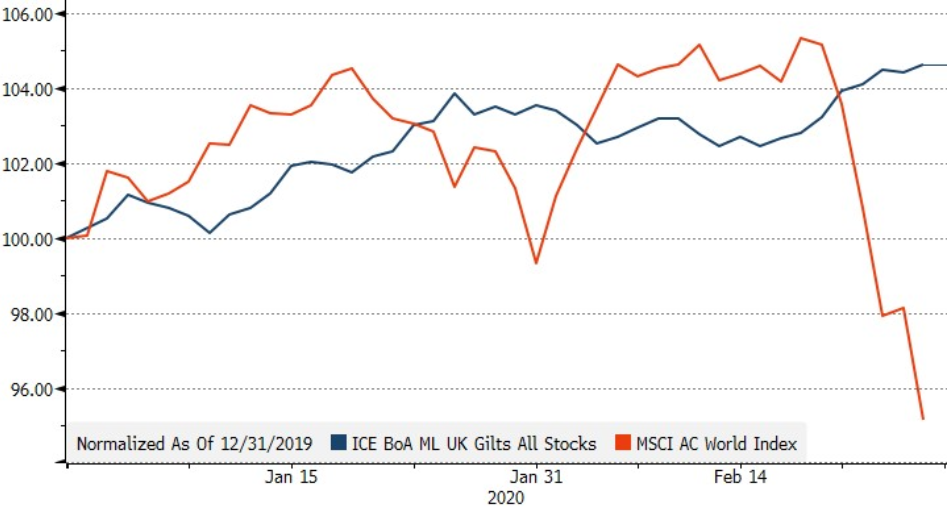

In market terms, the past week can be characterised as a ‘flight to safety’. Investors have sold riskier assets, such as stocks, and bought ‘safe haven’ assets such as high-quality government debt, including UK gilts.

Figure 1: While stocks have fallen, safe haven assets – such as gilts – have made gain

Exposure to gilts and other lower risk assets has therefore offered a degree of protection against the worst of the equity market falls. Our investment principles stress the importance of diversification: all OMPS portfolios include some exposure to these lower risk assets.

Exposure to lower risk assets is primarily attained through the bond and alternative funds in the Omnis range. These funds have collectively held up well through the market turbulence. As expected, the bond funds – which are largely invested in lower risk, high quality government and corporate debt – have been particular beneficiaries of the ‘flight to safety’. Meanwhile, the alternative funds – which, by design, should be less sensitive to short-term market gyrations, positive or negative – have broadly eked out smaller gains.

In general OMPS portfolios are underweight bonds, but overweight alternatives. Though we have missed out on some gains in the past week as a result, we continue to believe this position is justified. In our view, record low bond yields simply do not offer good value to long-term investors.

Our view on bonds would undoubtedly be challenged by the onset of a global recession. Despite understandable reductions in expectations for economic growth and corporate profits in the wake of the coronavirus outbreak, we do not believe recession is a likely scenario in the near-term.

Though growing relatively slowly, there are signs of encouragement for the global economy. Unemployment is at historically low levels, yet the absence of inflation has allowed central banks to maintain highly supportive monetary policy. Faced with the coronavirus threat, we expect central banks to remain supportive – or to become more so. Furthermore, there is scope for fiscal policymakers to join in: for a variety of reasons, governments in China, the US, the UK and Germany (among others) may be set to increase spending to support their economies. The prospect of co-ordinated policy support should go a long way to mitigate the economic impact of the coronavirus and to hold the threat of recession at bay.

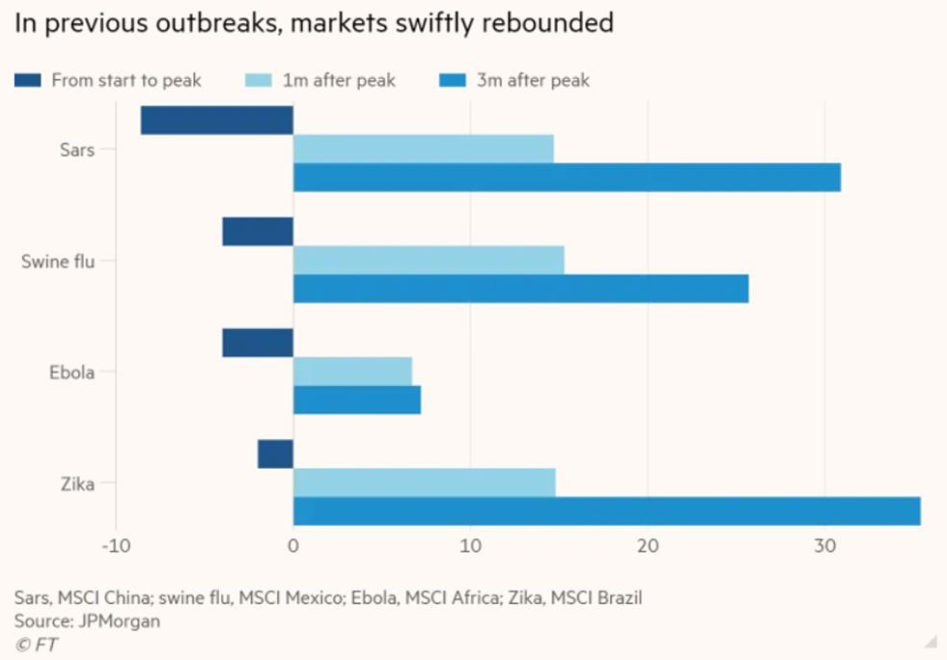

While the spread of the coronavirus is certainly unnerving – from both health and investment perspectives – it is not entirely without precedence. Though different in terms of geography, scale and contagiousness, we can look at market reactions to previous viral outbreaks to give us a sense of what to expect this time around. Typically, viral outbreaks have initially pushed stock markets lower. However, once the spread of the virus has been contained, stock markets have gone on to recover these losses and more.

Figure 2: Stock markets have recovered quickly from the initial impact of previous viral outbreaks

Taking all this into consideration, we have this week topped up equity allocations in OMPS portfolios, buying into the market decline. Though the viral outbreak will undoubtedly impact economic and corporate activity in the first quarter of this year, we do not currently expect this impact to be long-lasting. Most importantly, we entered this period of turbulence with the majority of equity markets trading at valuations we consider reasonable. Recent falls arguably present an opportunity to add further to equity allocations at valuations that may no longer be reasonable, but actively attractive. We are looking closely at these opportunities and stand ready to act as appropriate.

Though the temptation to join the ‘flight to safety’ is understandable, history suggests it would be the wrong thing for investors to do. A degree of contrarianism is often required to deliver superior returns: as per the maxim of Warren Buffet, it often pays to sell when others are greedy and to buy when others are fearful. We believe investors are currently acting more from fear than greed and, what is more, that this fear is not fully justified by the economic outlook. We are therefore prepared to stand our ground and, if the opportunity presents itself, to take the opposite side of the trade. In short, with what we know today, we are more likely to add to equity allocations than we are to reduce them.

Colin Gellatly

Deputy Chief Investment Officer,

Omnis Investments

This update reflects Omnis’ view at the time of writing and is subject to change.

The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with Financial Planning Hub. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information but no assurance or warranties are given. The value of your investment and any income from it can fall as well as rise and you may not get back the original amount invested. Past performance is not a guide to future performance.

Please note: by clicking this link you will be moving to a new website. We give no endorsement and accept no responsibility for the accuracy or content of any sites linked to from this site.