Two weeks feels like a long time in markets still searching for answers about the social and economic impact of the coronavirus pandemic. On 23rd March we wrote a note entitled “There is a Path out of this”. We said Italy and other nations would be close to a peak in new case rates and this has proven to be true, even if the rate of decline has been slower than we expected. We also said this would afford markets the opportunity to rally and almost from that point stock markets have risen sharply. The key question is what happens next?

T...

Life Insurance: It’s not for you, it’s for them! Life insurance is for your loved ones to make sure there is a roof over their heads and food on their table. It’s to ensure that they can continue to do the things in life you’d want them to, if the worst happened and you weren’t around.

You would want to be covered in the unlikely event that you were to die from COVID-19.

The cost of life insurance rises as you get older, so retaining your existing policy will help ensure you benefit from, in most cases, a lower monthly premium than you...

Active Management

Omnis firmly believes in the benefits of active investment management. While investors in passive vehicles have no option but to blindly follow the index – buying more of the things that have become more expensive and selling more of those that have become cheaper – active managers have the ability to direct money towards opportunities others appear to have overlooked or misunderstood.

At Omnis, we believe this flexibility is valuable, particularly when we experience the significant market turbulence we have witnessed ove...

In the Budget 2020 on Wednesday 11 March, the Chancellor announced changes to the Tapered Annual Allowance.

Rishi Sunak announced that the tapered annual allowance limits will be altered. The Threshold and Adjusted Income limits will move from £110,000 and £150,000 respectively to £200,000 and £240,000*.

Further to this the minimum Annual Allowance for those who are fully tapered will reduce from £10,000 to £4,000.

Threshold Income

Threshold income is:

- Taxable income for the tax year less

- Any taxable lump sum pension death benefits acc...

On Friday night, Fitch downgraded the government debt rating for the UK to AA- from AA. Fitch is one of the top three independent agencies (the others being Moody’s and Standard & Poors) that assess the risk of companies or governments not being able to pay back their debt. It is nothing to worry about for the UK as our debt is still close to the top rating on a scale that runs from AAA to BBB in investment grade with 11 possible levels based on intermediate classifications of +/-. The Fitch ratings break down as shown below. Each agency...

Coronavirus is having a huge impact on all of our lives and, it goes without saying, that this must be a very unsettling time for everyone. Not surprisingly, we've received a number of queries from our clients in relation to protection cover and claims which I have made every effort to provide answers to in the following Q&A section.

Am I still covered?

Providing you have paid your monthly premiums with your insurer, the cover we arranged remains in place and the terms of it are unaffected by the Coronavirus outbreak. If you have missed any ...

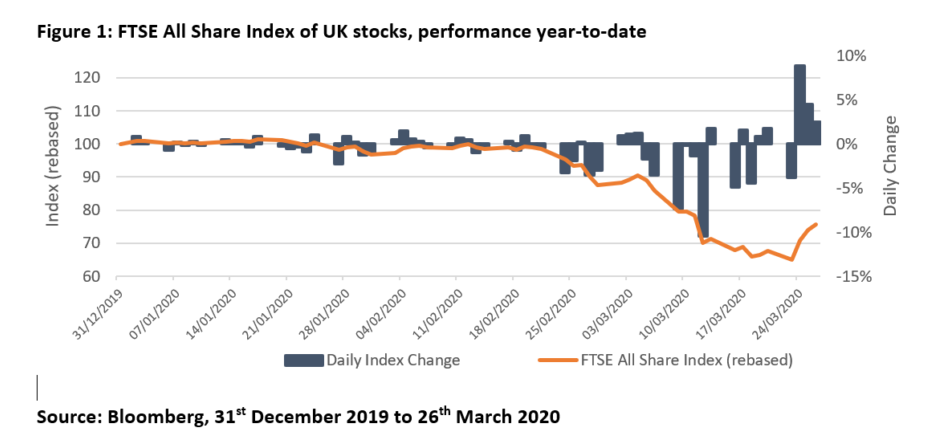

In recent weeks, investors may have become accustomed to seeing markets lurch lower day by day. The gains made this week – by some measures the strongest since 1931 – are therefore particularly welcome. While it is too early to sound the all clear, and while we would caution against attempts to ‘call the bottom of the market’, we believe the outlook is improving. Consequently, at current levels, we see compelling opportunities for longer-term investors in stock markets.

As previously explained (see ‘There Is A Path Out Of This’), ...

ollowing its emergence in central China in mid-January, the coronavirus has now been reported in 56 different countries. Of the more than 83,000 confirmed cases, nearly 3,000 have proved fatal. Though the rate of new infections in China has stabilised, and though the proportion of patients recovering has improved, the international spread of the virus has caused a great deal of alarm. As workers, shoppers and tourists stay home – either by choice or by government edict – expectations for economic growth and corporate profits have been revise...

Global stock markets fell sharply yesterday (Monday 24 February) as reports from Japan, South Korea, Iran and Italy stoked fears over the global spread of the coronavirus. Among the notable falls, FTSE MIB index of Italian shares ended the day 5.4% lower after authorities moved to lock down ten towns in the country’s north to prevent the virus spreading. Meanwhile, the S&P 500 index of US shares fell 3.4%, erasing its year-to-date gains. While stock markets dropped, safe haven assets which investors typically turn to in times of market turbu...

As the United Kingdom finally left the EU on 31 January 2020, there is now a transition period until the end of the year, while the UK and EU negotiate additional arrangements. The current rules on trade, travel, and business for the UK and EU will continue to apply during the transition period.

Globally, all attention has been on China where the coronavirus has now spread to 27 countries and territories worldwide, with 17,488 confirmed cases and 362 deaths (as of 3 February 2020).

The FTSE 100 ended January at 7,286.01 which was 3.4% low...