The Outlook Is Improving

Posted by siteadmin on Friday 27th of March 2020.

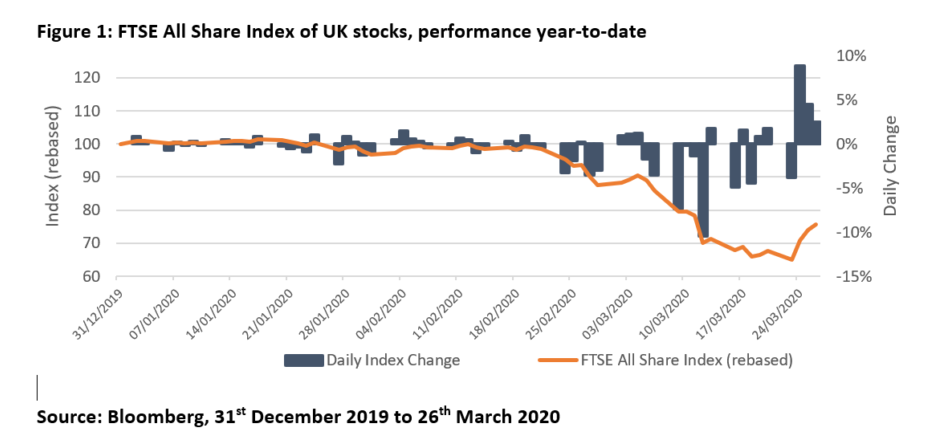

In recent weeks, investors may have become accustomed to seeing markets lurch lower day by day. The gains made this week – by some measures the strongest since 1931 – are therefore particularly welcome. While it is too early to sound the all clear, and while we would caution against attempts to ‘call the bottom of the market’, we believe the outlook is improving. Consequently, at current levels, we see compelling opportunities for longer-term investors in stock markets.

As previously explained (see ‘There Is A Path Out Of This’), we have been closely monitoring a number of issues to help guide our expectations over the remainder of the year and beyond. This week has seen important developments in many key areas.

Firstly, we have seen signs that central bank policy designed to support the infrastructure of the global financial system is doing its job. The importance of this is hard to overstate: it means the risk of a full-blown financial crisis is receding.

Secondly, monetary and fiscal policymakers have unleashed unprecedented levels of support for the economy. For example, the Bank of England has committed to a new round of quantitative easing equal to 9% of the UK’s annual economic output while Chancellor Rishi Sunak has promised new government spending equivalent to 4% of annual output. These measures surpass those undertaken in the 2008 financial crisis in both the speed and the scale of deployment.

Importantly, the policy response has been aimed directly at those facing the biggest disruption from efforts to contain the spread of coronavirus. In the UK, the government has pledged support to small businesses and the self-employed while subsidising wages to discourage companies from making workers redundant.

In the US, fierce debate in the Senate has led to unanimous approval of a $2tr spending plan incorporating direct payments of $1,200 to every adult and $500 to every child. These policies (and many more implemented around the world) should help limit the economic impact of the virus and, furthermore, add fuel to the subsequent recovery.

Thirdly, there have been signs, albeit fleeting, that the spread of the virus is slowing in badly affected places such as China, Korea and Italy. It remains difficult to map a reliable pattern for the growth, spread and containment of the virus: different countries have been infected at different times, and the response of national authorities has varied. Nonetheless, any evidence of containment is welcome, from both humanitarian and investment perspectives.

These developments have reinforced the potential for a robust recovery (both in economic activity and stock market levels) in the second half of this year and beyond (see ‘Focus On The Horizon’).

Of course, we must recognise that unforeseen events could undermine our relatively optimistic outlook. With this in mind, we are paying close attention to global employment data, infection rates in Asia and the actions of the Trump administration. Unemployment will certainly rise over the next few months, but we will be looking for signs that the increase is being limited by central banks and government policy.

While some Asian nations (most notably China) appear to have had some success in containing the spread of the virus, any signs of a second wave of infections as people return to work would be a concern.

Finally, while national authorities have reacted to coronavirus in a variety of ways, the Trump administration’s response has been particularly haphazard. The number of cases reported in the US now exceeds that reported in China, and there is legitimate concern that the US is ill-prepared to deal with the pandemic threat.

While we continue to closely monitor developments in these areas and elsewhere, we believe the case for a strong economic recovery later this year and into 2021 remains in place for now. We would caution investors to expect financial markets to remain turbulent on a day-to-day basis, nonetheless we believe the opportunity for longer-term investors is an attractive one.

Colin Gellatly

Deputy Chief Investment Officer

Omnis Investments Limited

Omnis Investment Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your Openwork financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given.

The value of an investment and any income derived from it can fall as well as rise and you may not get back the original amount invested. Past performance is not a guide to future performance. The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Washington House, Lydiard Fields, Swindon, SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.

Please note: by clicking this link you will be moving to a new website. We give no endorsement and accept no responsibility for the accuracy or content of any sites linked to from this site.